Professional financial planning is the process of meeting your life goals through the proper management of your finances. We all have things that we wish to achieve in life, yet without proper financial planning you may find that your money and assets aren’t working as hard for you as they should be. It may be that you have accumulated an element of wealth or perhaps you aspire to be financially independent someday.

Our task is to help you assess where you are now, and clearly define and understand your goals for the future. We then work with you over the longer term to help you achieve your aspirations.

Professional financial planning provides direction and meaning to all your financial decisions. It also allows you to understand how each financial decision you make affects other areas of your finances.

By viewing each financial decision as part of a whole, you can consider its short and long-term effects on your life goals. You can also adapt more easily to life changes and feel more secure that your goals are on track.

In short, we can’t do our job without knowing what’s important to you. We need to establish & define the "Lifestyle" or outcomes you require (the big picture approach) and then identify the strategy you will need use to achieve that lifestyle.

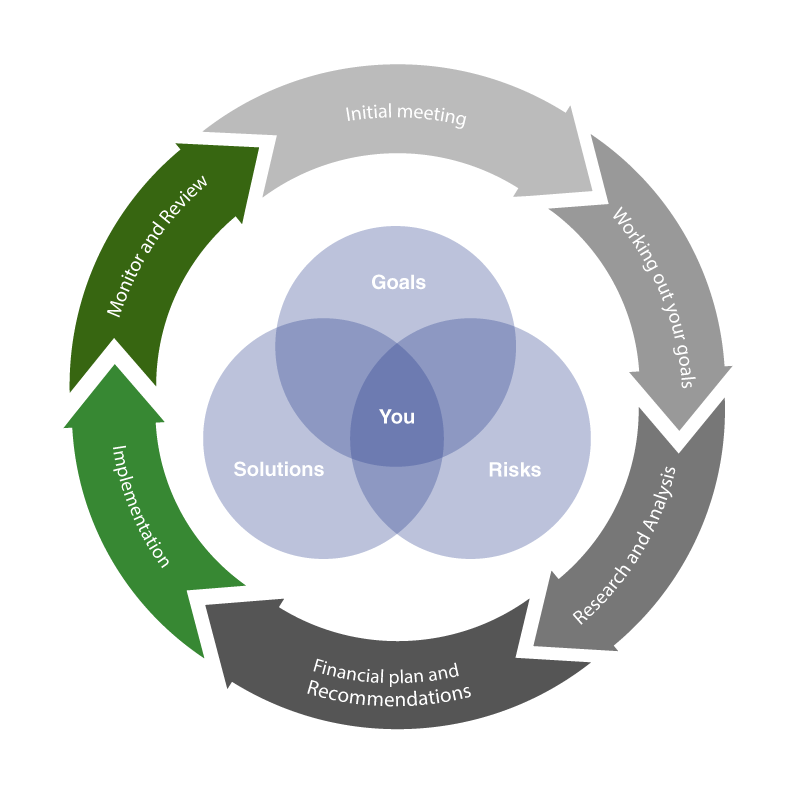

How we work with you

Initial Meeting

Our first meeting will be an opportunity for us to get to know each other a little better. We will take this time to discuss how we will work with you, and to find out if financial advice is appropriate for you, whilst discussing our standard services and fees.

Working Out Your Goals

Working with you, we will establish your short, medium, and long-term goals and your attitude to risk. We will work out with you the cost of achieving your goals and analyse and evaluate your financial status.

Research & Analysis

Along with this information, any current provision that you may have through existing arrangements will be thoroughly audited and analysed to establish whether these still meet your current needs and identify any shortfalls.

Financial Plan & Recommendations

All this information will enable us to develop a personalised plan for you, including tax and investment strategies that could be used to achieve your financial goals. These will be discussed in detail with you for your consideration.

Implementation

Once you have decided that you are happy to proceed, we will then help to implement the agreed plan.

Monitor & Review

Regularly reviewing your financial strategy is equally as important as the initial analysis and implementation to ensure that it continues to deliver its intended aims, for instance changes in tax legislation, personal circumstances, your attitude to risk or your objectives may change.

We also offer our Personal Finance Portal which allows you to access to your plans and enables you to update your personal details online.